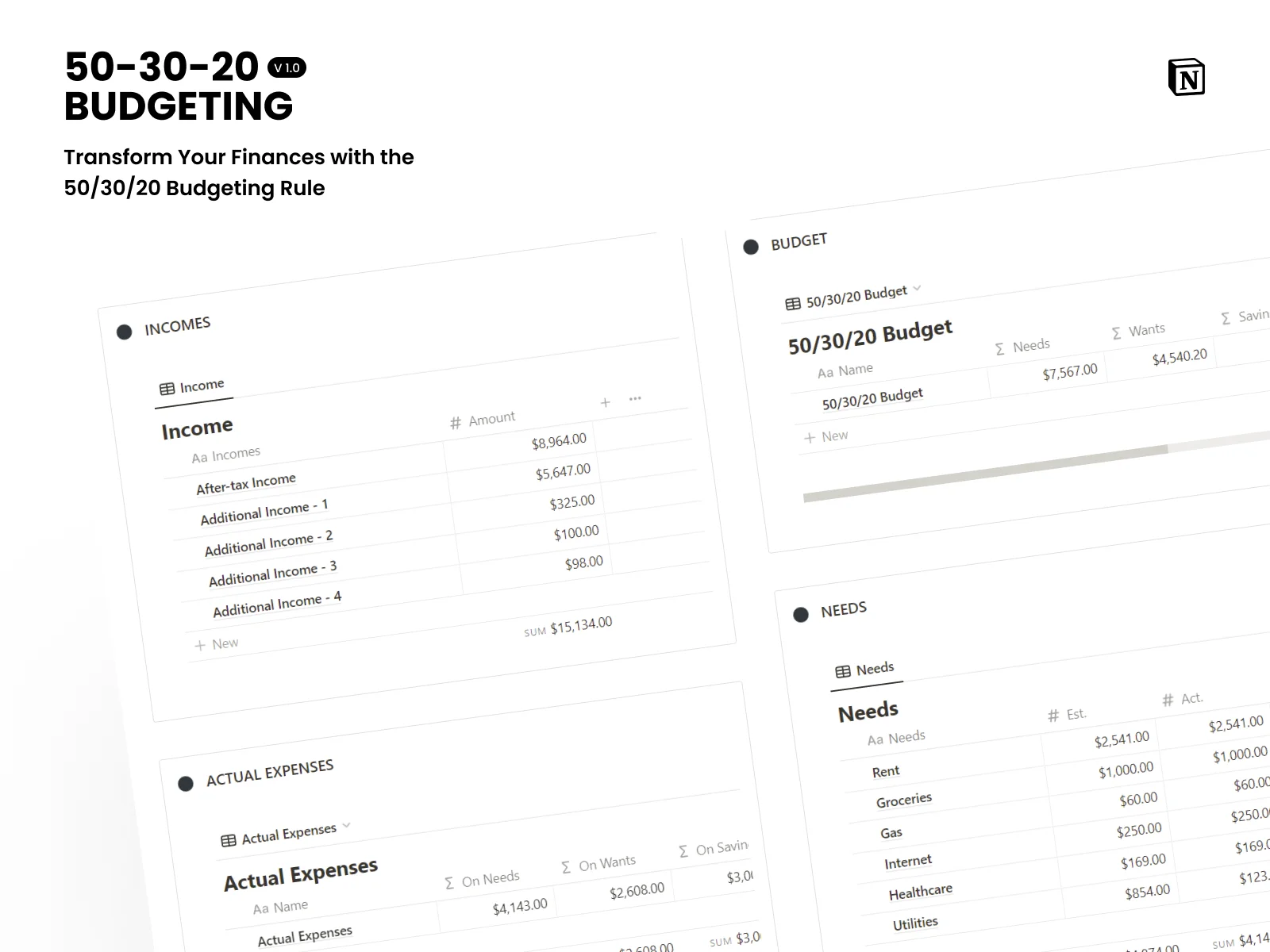

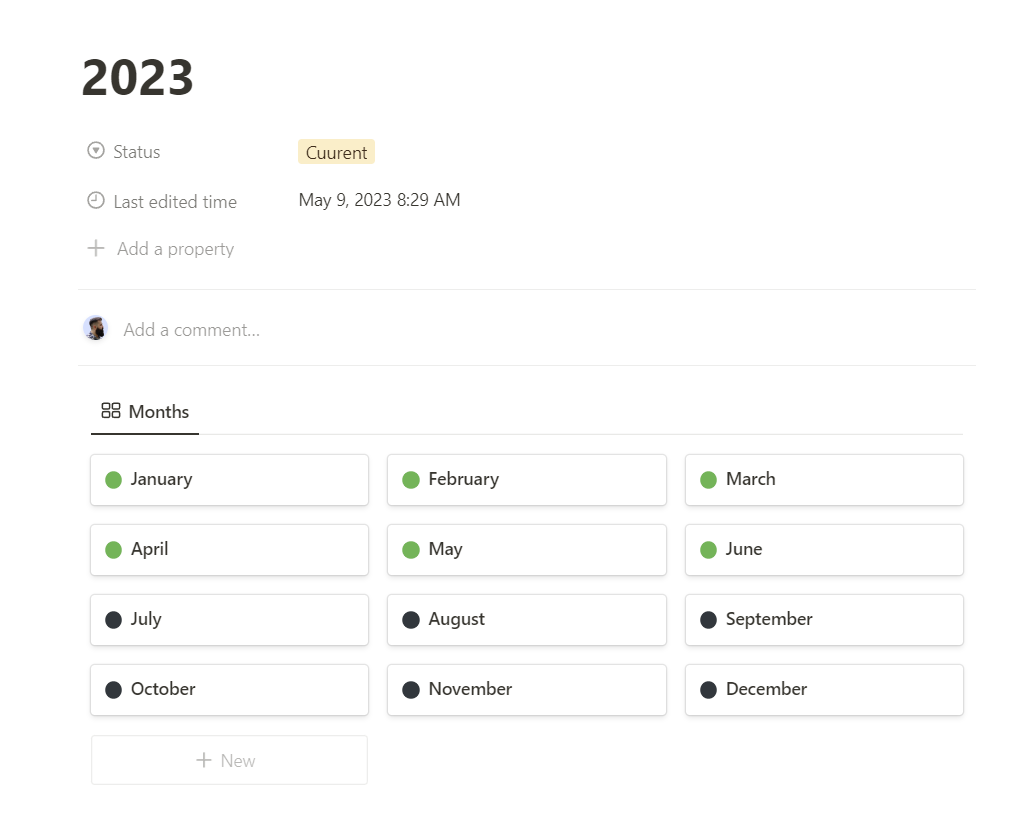

Notion Templates

Business Hub

The complete Notion system I use every day to manage my 12+ businesses.

Super Brain

My personal second brain system to clear my mind, set goals, and manage knowledge.

Blog

My reflections on life, wealth, entrepreneurship, philosophical ideas, productivity.

Sharing insights on building and scaling online businesses.

Strategies for growth, self-improvement, and achieving your goals.

Tips, templates, and techniques to organize your life and boost productivity

Latest news, announcements, and insights about my projects, products, and personal journey.